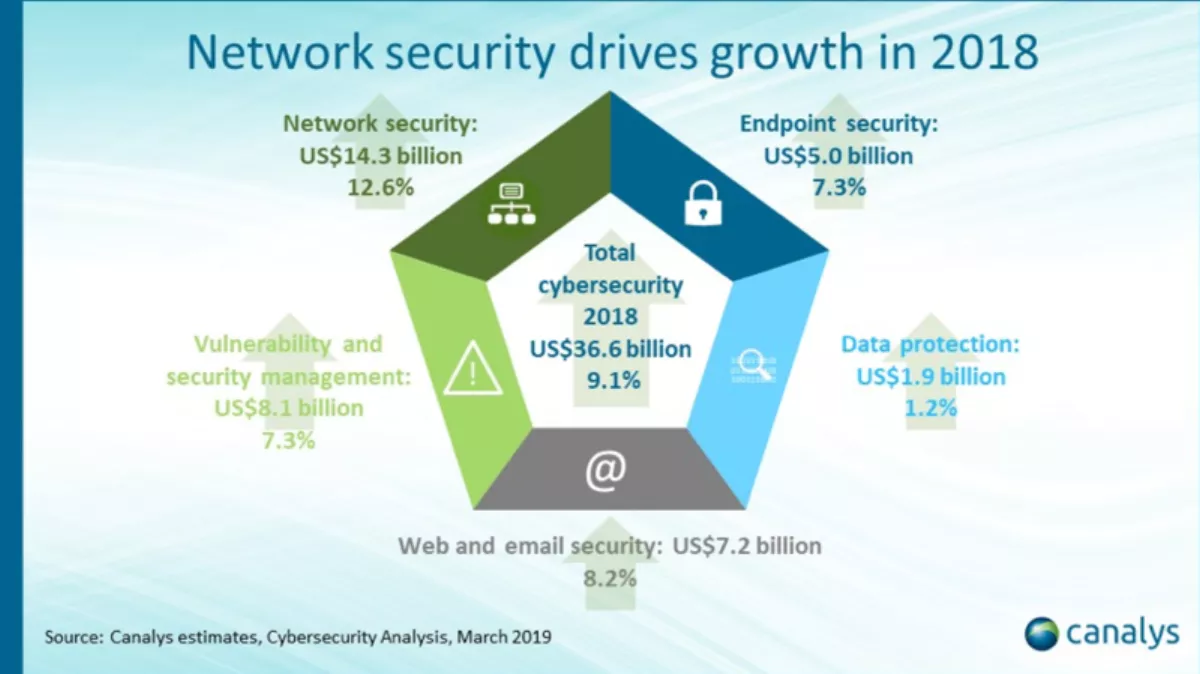

Industry analyst firm Canalys estimates that worldwide cybersecurity technology spending reached US$37 billion in 2018, up 9.1% from 2017.

The standout segment was network security, which was up 12.6% year on year, thanks to the creation of hybrid and complex environments.

Web and email security products grew 8.2%, followed by endpoint security, and vulnerability and security management solutions, both growing 7.3%.

Growth rates within the different regions were similar, ranging from 7.0% in APAC to 10.5% in EMEA, with Latin America at 9.2% and North America 8.9%.

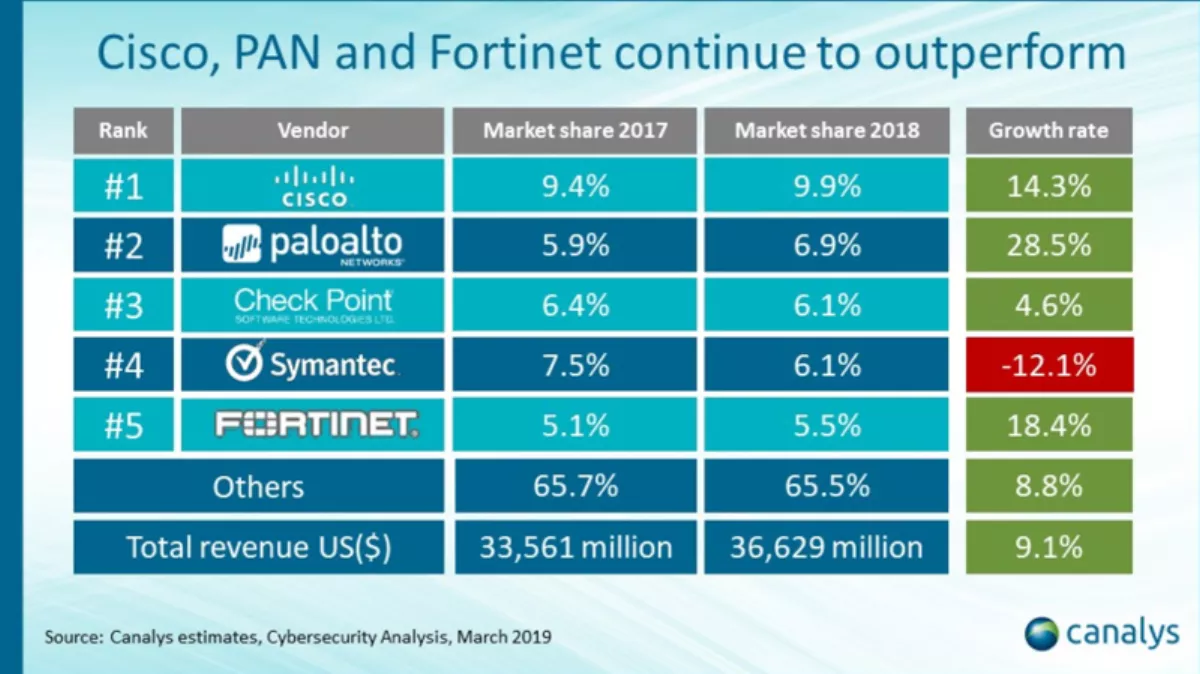

Cisco, Palo Alto Networks and Fortinet, all with a strong focus on network security products, outperformed the market, recording strong double-digit growth.

“The fast adoption of multiple cloud services by enterprises, which often keep on-premises infrastructure as well, has created hybrid environments which are complex to define and protect,” says Canalys research analyst Claudio Stahnke.

This is driving growth for network security products, especially those solutions that enable the creation of a perimeterless architecture, favouring vendors with a wide array of tools in their portfolios,

Check Point was in third place, growing 5% thanks to its cloud security offering, which was recently expanded in identity management and web security with the acquisitions of Dome9 and ForceNock respectively.

Finally, Symantec is expected to rebound this year after declining 12% in 2018, closing a difficult period after the fallout from an internal probe affected sales.

“We have seen many acquisitions in the cybersecurity space in 2018 as vendors are expanding their offerings to profit from the complexities that end users are facing,” Stahnke adds.

“This will not stop in 2019 as the market remains highly fragmented and new threats force incumbents to further expand their platforms.

Cybersecurity quarterly estimate data is taken from Canalys' Cybersecurity Analysis service.

Estimates include technologies across network security, endpoint security, web and email security, data security, and vulnerability and analytics security.

The subscription service tracks the transition of deployment options from hardware and software to services, public cloud workloads and virtual appliances/agents by channel and end-user size.